Successfully attracting foreign talent

HOFFMAN NEWSLETTER

November 2022

Belgian employers can now more easily offer an attractive package for the right talent using a new specific tax regime.

Hoffman / IIC Partners White Paper on “Biotech Talent Management, an industry of major growth” highlighted the need for international recruitment. This is particularly true in Belgium where Biotechs and Medtechs are mushrooming and the local pool of talent is far too small. More generally, the need to ensure sufficient diversity and the scarcity of talent push many Belgian employers in all sectors to ever more recruit abroad.

After finding the right talent, one of the important factors to succeed in attracting them is to be able to offer an attractive package. Belgium has therefore developed a new special tax regime for this purpose. It is particularly important to note that this regime is not limited to any sector and can therefore be used by all employers meeting the required criteria.

We discussed this new regime with Sylvie Dumortier, Tax Counsel at the major Belgian actor in HR legal services, the lawyer office Claeys & Engels.

Sylvie, can you summarise this new regime that supports the employers in offering an attractive package to foreign talents ?

This new favourable tax regime is especially designed to attract qualified workers from abroad to Belgium. By helping Belgian-based companies to attract workers with specific skills that sometimes lack on our domestic labour market, this regime also aims at strengthening the competitiveness of Belgian companies. This new regime, called “special tax regime for incoming taxpayers and researchers”, replaces the old special tax status for foreign executives governed by the administrative circular of 8 August 1983 and is in place since 1 January 2022.

Unlike the old regime, the employer where the incoming taxpayers or researchers work does not have to be part of an international group anymore. The scope of application of this new regime is therefore broader since it can be implemented in any Belgian resident company, Belgian establishment of a foreign company or any not-for-profit organisation.

Under the new regime, the employer can pay, on top of the employee’s remuneration, a special allowance that is totally free from Belgian social security and Belgian tax. Legally speaking, this allowance is considered as a cost proper to the employer and is therefore not subject to (para-)fiscal charges.

The amount of the allowance can be freely fixed by the employer but cannot exceed 30% of the annual gross remuneration and is limited to an absolute maximum of EUR 90,000 per year.

In addition to this (lump-sum) allowance, the employer may, within certain limits, contribute to the costs of the expatriate’s relocation, the costs of arranging the residence in Belgium and the school fees of the children of the expatriate or his/her partner. These additional contributions are also exempt from tax and social security. The law distinguishes the status of incoming taxpayer from the one for incoming researcher.

Can you describe the conditions to benefit from the regime for incoming researchers ?

To benefit from the special tax regime for incoming researchers, the persons must not have been subject to the Belgian personal income tax/non-residents tax (on professional income) during the 60 months prior to their employment in Belgium, nor must they have lived within a perimeter of 150 km from the Belgian border. In addition, the researcher has to hold a master’s or doctor’s degree in one or more specific fields of specialisation. Alternatively, he/she qualifies too if he/she demonstrates at least 10 years of relevant professional experience. In addition to a CV, this experience must be proven by references from former employers, publications, training courses given, etc. Lastly, the researcher is required to perform, for at least 80% of his/her working time, scientific, fundamental, industrial or technical research activities within a laboratory or a company engaged in one or more R&D programs.

Looking at management roles -in any company- are there other measures that make it especially attractive for foreign talents to consider relocating to Belgium ?

Yes, for those who do not have a qualifying degree and/or do not spend at least 80% of their time in research activities, it is possible to benefit from the special tax regime for incoming taxpayer. The two general conditions linked to the absence of taxation in Belgium and residence within a perimeter of 150 km from the Belgian border during a 60-month period also apply. However, a minimum level of remuneration is required for the incoming taxpayer, which is not the case for incoming researchers.

The minimum annual gross remuneration (i.e. before deduction of personal social security) has to amount to EUR 75.000 and must relate to activities that are taxable in Belgium.

What advice would you give to employers who are considering opting for this new special tax regime ?

As explained, the introduction of this new special tax regime for incoming taxpayers and researchers offers new opportunities for attracting foreign talent through an attractive remuneration. This is possible thanks to the exempted character of the 30%-allowance, which is considered as a cost proper to the employer.

When drafting the employment contract, employers should pay attention to the wording of the clauses on remuneration and the exempted allowance. The payment of the allowance has to be contractually agreed and must be paid on top of the gross salary. Therefore, it is not possible to stipulate that the 30%-allowance is included in the agreed gross salary. Also note that the 30%-allowance is a maximum. In other words, the employer could decide to provide an absolute amount or a lower percentage than 30% on top of the remuneration provided of course it does not exceed the 30%-maximum or EUR 90.000 per year.

Moreover, in order to benefit from the new regime, the employer must submit an electronic application to the tax administration within three months following the start of the taxpayer’s employment in Belgium. This status is limited in time to 8 years (knowing that an application for renewal must be made after 5 years in order to benefit from the scheme for 3 additional years). The benefit of the scheme also implies that the threshold of 80% of time spent on research or the remuneration threshold of EUR 75,000 remains fulfilled.

It is worth noting that the choice of regime (i.e. the one applicable for incoming researchers or the one for incoming taxpayers) is definitive and that it is not possible to switch from one regime to the other. In other words, a person who has opted for the special regime for incoming researchers and who decides after a few years to take up management functions – which implies he/she does no longer devote 80% of his or her time to research activities – will not be able to avail him or herself of the EUR 75,000 remuneration threshold if he or she has not explicitly requested the application of the regime for incoming taxpayers from the start. Concretely, it means that if a researcher exceeds the EUR 75.000 remuneration threshold in any case, it’s preferable to opt as from the start from the special tax status for incoming taxpayer so that he/she does not have to care about the time spent in research activities.

Could you illustrate with a concrete example the financial advantages of this regime for both the employee and the employer ?

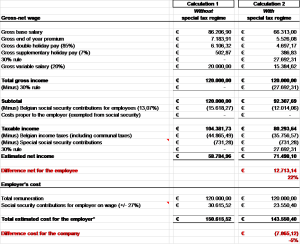

Say the employer intends to offer a gross package of EUR 120.000 (being EUR 100.000 as gross salary and a target bonus of 20% (EUR 20.000) to an employee from Spain for example. He/she had never lived or worked in Belgium before.

Under the new special tax regime, a reduced salary of EUR 100.000/1,30, being EUR 76.923,08 can be agreed upon. The target salary of 20% will be reduced proportionally as well (EUR 20.000/1,30 = EUR 15.385,62). However an exempted allowance of EUR 27.692 (30% of 76.923,08 + EUR 15.385,62) can be granted on top of the salary under favourable conditions. This leads to a 22% increase of the employee’s net income and a 5% decrease of the employer’s cost (calculation 2), compared to the standard tax regime (calculation 1):

Improving the net for the employee by 22 %

while reducing the cost for the employer by 5 %

As illustrated, the new regime can certainly contribute to make it easier to offer an attractive package to talents we identify abroad. And to reduce the total cost for the employer. But the application modalities remain complex even though the law was intended to simplify the system. As we are still waiting for further comments on the practical application of the system … stay tuned !

Sylvie Dumortier, Tax Counsel, Claeys & Engels

sylvie.dumortier@claeysengels.be

Michel Grisay, Partner, Hoffman

mg@hoffman.be